Six practical considerations for banks when outsourcing payments.

February 2, 2021

Don’t forget to look under the hood!

The pace of change impacting payments is staggering.

Regulatory and industry initiatives have been flooding the payments market in the last few years, such as PSD2/Open banking, the optional – and probably in the coming year or so mandatory – SEPA Instant Payments, SWIFT gpi, the interbank ISO 20022 migration, SEPA Request-to-Pay, the TIPS and T2/T2S consolidation and last but not least, the European Payments Initiative. Customer requirements are increasingly more demanding and more and more FinTechs are offering specialized functions, such as international payments, anti-financial crime solutions, AI virtual assistance and financial insight solutions that can be tapped into. At the same time, the bank’s payment margins are under pressure, payments are increasingly seen as a commodity, non-differentiating product.

From the technological point of view, and certainly important for an ‘IT-intensive’ market such as payments, APIs and cloud are major game changers. I have seen from close by that bank payment engine development costs nosedived from tens of millions of euros (cobol/mainframe) to millions (framework/midrange) to hundreds of thousands (framework/cloud) in just over a dozen years!

In such a dynamic and inherently uncertain market the bank needs to consider their payments sourcing strategy carefully. How to deliver more, faster for less AND stay operational excellent. The old habit of doing everything yourself is not sustainable anymore, certainly not if you are Tier 2 or 3 bank. In the introduction of the ‘EBA revised Guidelines on outsourcing arrangements’(February 2019) the European Banking Authority states ‘Over recent years, financial institutions have been increasingly interested in outsourcing business activities also in order to reduce costs and improve their flexibility and efficiency’. This has been true for payment as well and payments outsourcing has become a very serious option and many banks have acted upon this already.

Why outsource?

There are several, somewhat interrelated, reasons to consider outsourcing:

- Cost efficiency: realize a lower and more flexible cost base,

- Technology jump: leap to a leading technology base through a service provider,

- Redirecting focus: spend less time on commodity processes and remaining compliant, and redirect focus to customers and new business value,

- Decrease implementation and operational risk: acquire a proven service,

- Gaining agility: should result from the above if executed well.

A key condition is that the payments outsourcing service is secure and operational excellent – with the move to Instant Payments, payment processing is becoming more and more critical and glitches lead to increasingly higher market and customer exposure.

Many forms of outsourcing

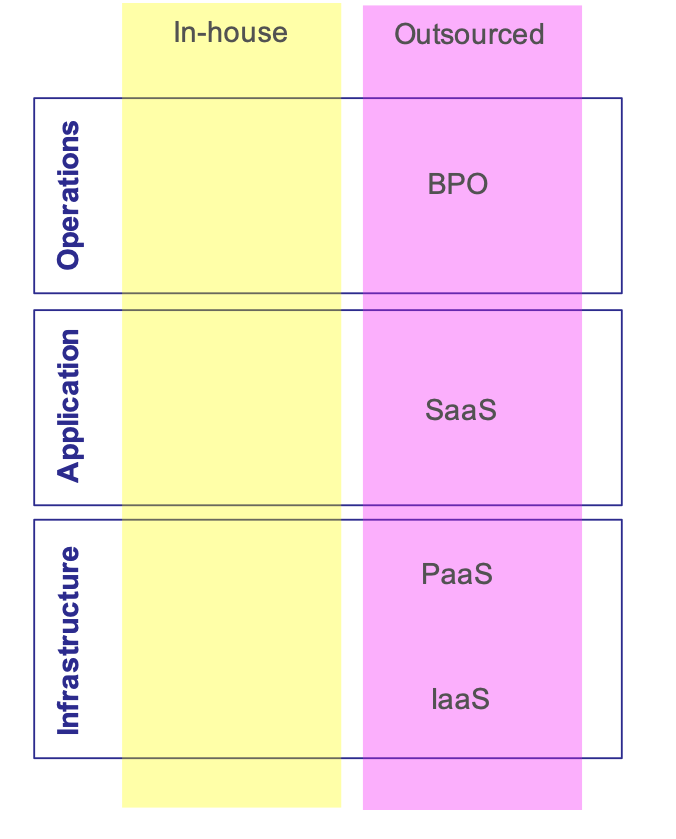

When talking about outsourcing it is important to define what form of outsourcing one is considering as there are many flavors such as IaaS, PaaS, SaaS, BPO (see graphic 1).

IaaS: Infrastructure delivered as a service, for instance via a cloud provider.

PaaS: Platform for software creation delivered as a service, i.e. infrastructure and development and deployment support tooling included.

SaaS: Software provided as a Service, including hosting.

BPO: Business Process Outsourcing provides operational staff to manage a business process.

Graphic 1: outsourcing options

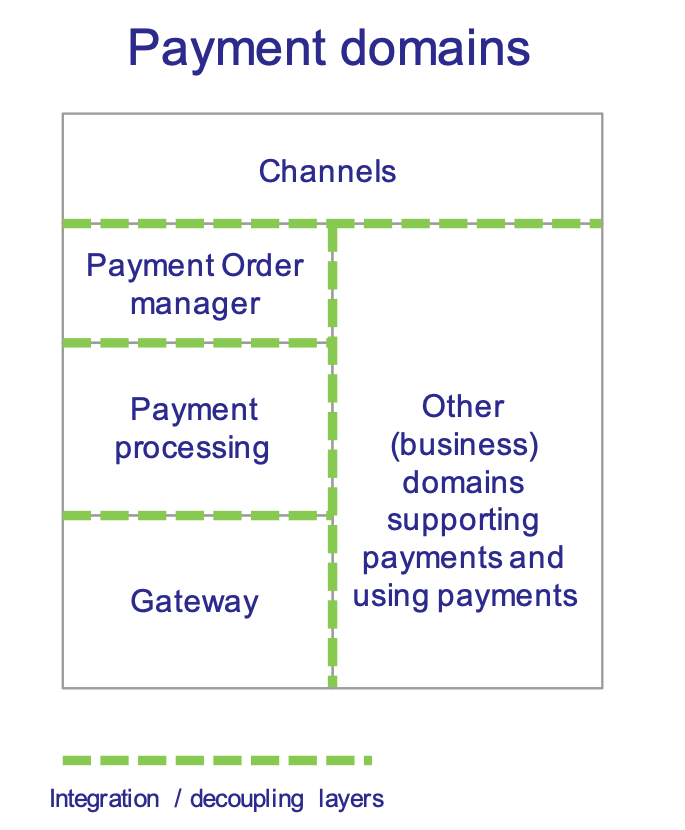

Apart from the options for outsourcing one will also need to think the sourcing options through per payments domain (see graphic 2, such as channels, order manager, payment processing, market gateway, depending on what is available, what agility you require and costs of integration.

Graphic 2: payment domains and potential Integration / Decoupling Layers

The aforementioned outsourcing options can be implemented as a mix-and-match when taking requirements such as control, available providers, etc., into consideration. An option for instance could be to acquire a modern payments platform (including maintenance and change support) and have it implemented on the bank’s existing IaaS arrangement. Alternatively, SaaS can be a preferred choice as it offers a very comprehensive service, including hosting and maintenance, leading to a substantial ‘off-load’ of activities.

We will therefore now focus on SaaS.

The six practical considerations to consider when outsourcing to a SaaS providers

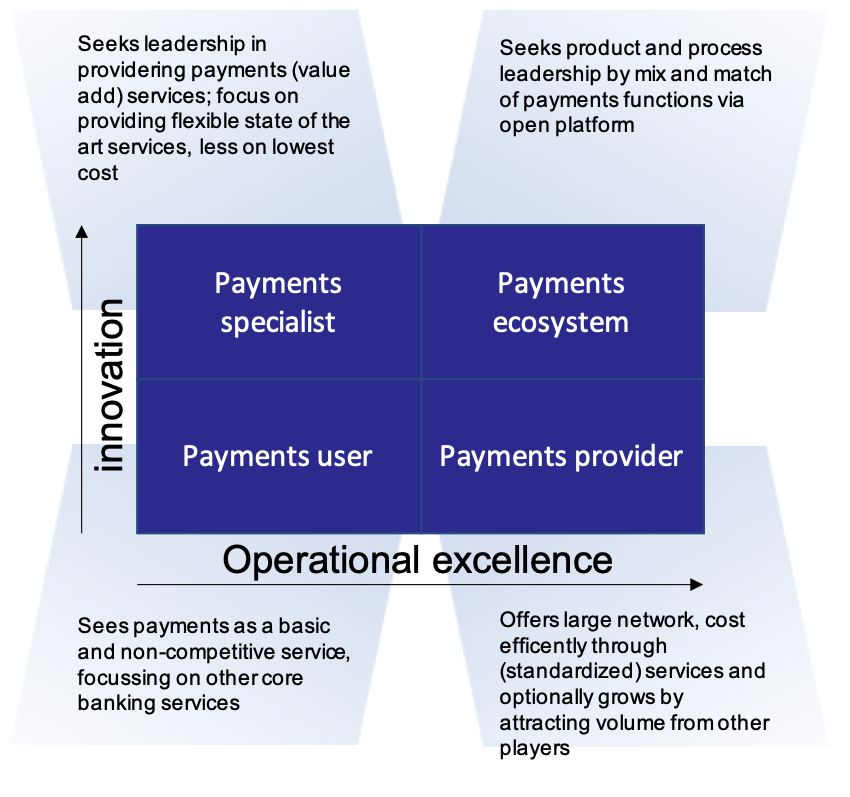

- Your payments strategy: Do you need to be a ‘payments specialist’, i.e. offer the latest and greatest to retain and attract customers or is payments more an enabler for your core business (being a ‘payments user’), as for example for banks with focus on wealth management. This will drive your decision for outsourcing, i.e. your (future) change requirements and what part of the payments domain to potentially outsource. Please also refer to graphic 3.

Graphic 3: bank payments profile and strategy

- Functionality and Technology: It is important to ensure your outsourcing provider offers the functionality you require out-of-the-box, such as e.g. Instant Payments. However, it is even more important to look under the hood at the technology platform (e.g. real-time core, cloud native) and the architectural design your provider brings. If it is not state-of-the-art, you will not reap the advantages of the huge technological advances made recently and you will be on a path that diverts you away (again) from cost efficiency and agility.

- Transformation: One should consider transformation as an integral part of outsourcing, i.e. use the migration to an outsourcing provider as an opportunity to adapt the internal payments architecture by introducing strict decoupling layers between order manager, account management domain and the payments processing. Benefits: more flexibility and less integration when (re)outsourcing in the future is needed. Your provider should have the ability to facilitate a progressive transformation, avoiding big-bangs and associated risk.

- Trusted partner: Choosing a trusted partner is very important as you handover your all-important payment process to an external entity. Is and will the outsourcing provider remain a solid partner in the coming years? What is its track record in payments, maturity and expertise of management and staff? What is the ownership structure, vision and projected profitability? Do they offer Continuous Integration/Continuous Delivery? Do they have the required certifications and assurances such a ISAE 3402? What off-boarding process is offered when the service needs to be terminated? In selecting a trusted partner one could select (or set-up!) a provider that offers holding a share or is in fact a shared service center. Holding a share can provide a form of control over the payments service, strategy and joint benefits.

- Client influence: In many cases the payments process differs from bank to bank. This might be how exceptions are handled, Direct Debit retries in case of insufficient funds, but also PSD2 PIS API definitions/options and the value add services you (need to) offer to your customers. The service provider needs to offer configuration options and ease of implementing future changes and adding new business services. How actively are user groups managed and how does your business compare to other users? If you your type of bank is different from the other users, your (future) needs may be more difficult to fulfill or more costly. What options do you have in case you want to source it back in or change providers?

- Business case: For the business case to make sense, cost efficiency is important (now and in the future!), especially for ‘payments users’. But in many cases, it will be crucial that outsourcing offers future new business value. Ideally you will want to outsource your ‘hassle’ and at the same time get agility and new business opportunities in return.

Conclusion

Outsourcing of payments (to Saas / BPO providers) is a trend that has only really taken off in the last couple of years. As a result, many parties are stepping into this arena and a wide variety of service providers at different stages of development are now in the market, such as traditional payments processors (bank or non-bank), traditional payments software providers now offering their software as SaaS and new cloud native SaaS providers. Some may have a track record of many years, but might offer only a legacy platform and vice versa. It will be interesting to see how the market of payments service providers pans out in the coming years and what leaders emerge. There are many important aspects to consider when evaluating your best service provider, such as functionality offered, technology platform, provider maturity and business model. There is no one-size-fits-all approach and outsourcing options need to be evaluated case by case, but one thing is very clear: it is very important to thoroughly evaluate the technology offered. Otherwise, you will not be able to leverage the impressive technology advancements made in the last years, impacting your competitiveness unnecessarily from day one.

About the author

Paul van der Valk is a senior international professional specialised in payments consultancy, program and product management. In the last 20 years he has been involved in projects for the development and implementation of SEPA & Instant Payments (SCTinst), PSD2/Open Banking, (SEPA) Request to Pay, CSM (ACH), Payments Outsourcing, Payments Engine, Payments SaaS services.

Linkedin: Paul van der Valk